Pitch Deck Teardown: Plantee Innovations’ $1.4M seed deck

It’s rare that I come across a pitch deck that ticks almost all the boxes. It’s so good, in fact, that I fed Plantee’s deck into an AI tool I built, and it determined there was a 97.7% chance that Plantee would raise money. This tool generally determines that only about 7.5% of all pitch decks are up to scratch, so Plantee’s is positively off the charts.

What the robots didn’t pick up, however, was that Plantee’s Kickstarter campaign was canceled before it was completed, and there are a few other confusing bits as well. Let’s dive in to see what works, and what could be improved.

We’re looking for more unique pitch decks to tear down, so if you want to submit your own, here’s how you can do that.

Slides in this deck

- Cover slide

- Summary slide

- Team slide

- Advisers and investors slide

- Mission slide

- Market validation slide

- Problem slide

- Solution slide

- Product slide

- Competitive landscape slide

- Traction slide

- Target customer slide

- Market size slide

- GTM slide

- Pricing & unit economics slide

- Vision slide

- Ask and Use of Funds slide

- Operating plan slide

- Closing slide

- Appendix slide I: Products in development

- Appendix slide II: Sources and references

Three things to love about Plantee’s pitch deck

It turns out that Plantee’s team has been reading my Pitch Deck Teardowns very carefully indeed, and it shows. The company includes tons of details in its deck.

That’s how you do an introduction!

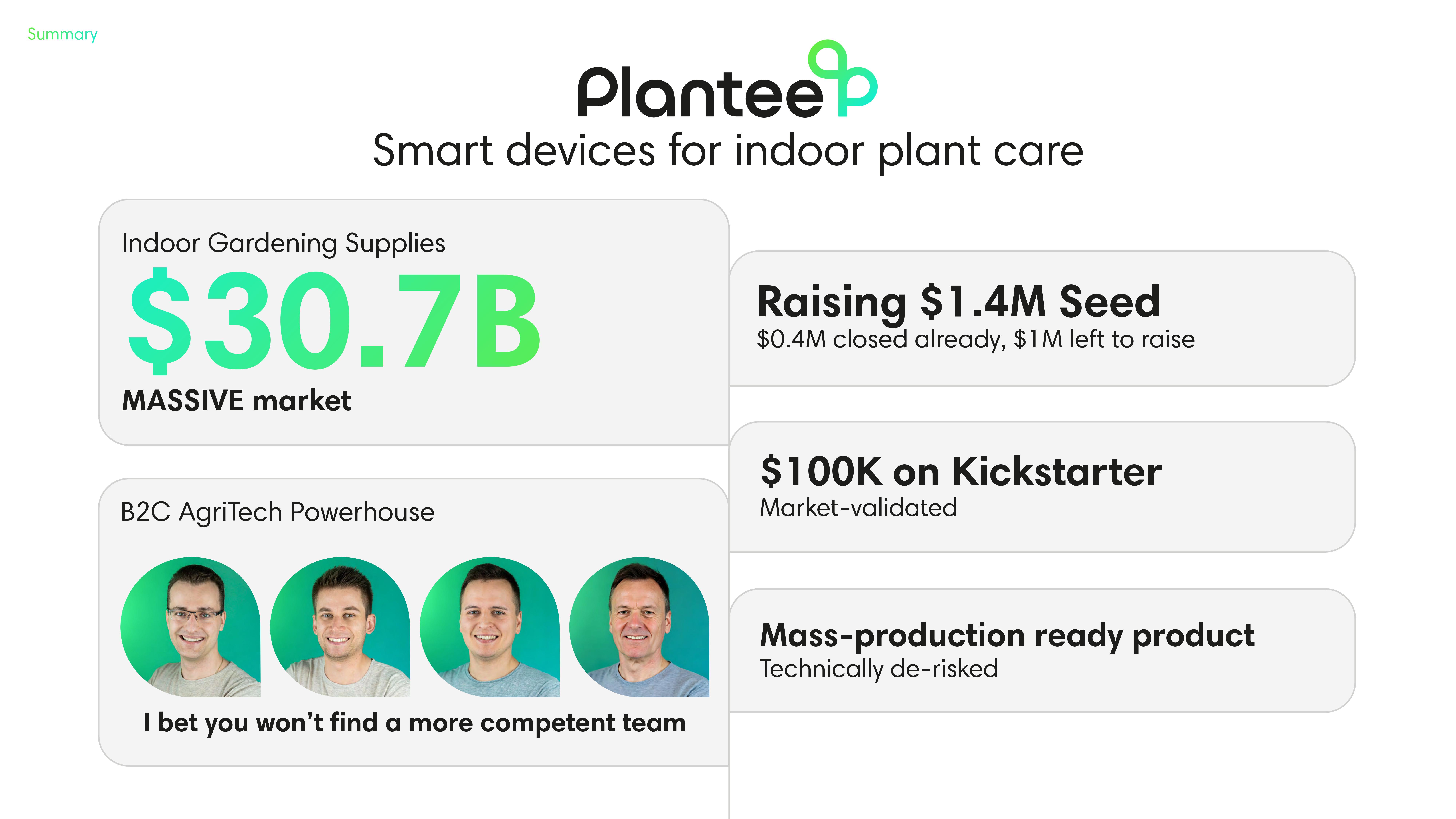

Slides 1 and 2 together (Slide 1 is at the top of the article) set the stage for an investor to 100% understand the what, why and how of the company:

[Slide 2] A one-page summary to applaud. Image Credits: Plantee

The opening slides of Plantee Innovations’ pitch deck are rock solid. Between the two slides, the founders offer a clear and engaging introduction to what the company stands for and aims to achieve. The succinct overview captures the audience’s attention right from the start but also serves a dual purpose of efficiently level-setting for investors and filtering interest based on investment thesis alignment. The cover slide includes “IoT Smart Home / B2C Consumer Electronics / AgriTech / Raising $1.7M” — it’s basically keyword bingo that helps investors decide whether to lean in or whether to trash the deck right away. That’s a good thing: If this company isn’t a good fit with investors, they can move on right away.

Gotta love a good tech solution

I’ll be the first to admit that I’m a raging nerd, and I love a good gadget. I also love plants; I have dozens all over my apartment, and I can keep most of them alive. As outlined, I love Plantee’s approach to foolproofing plant parenthood.

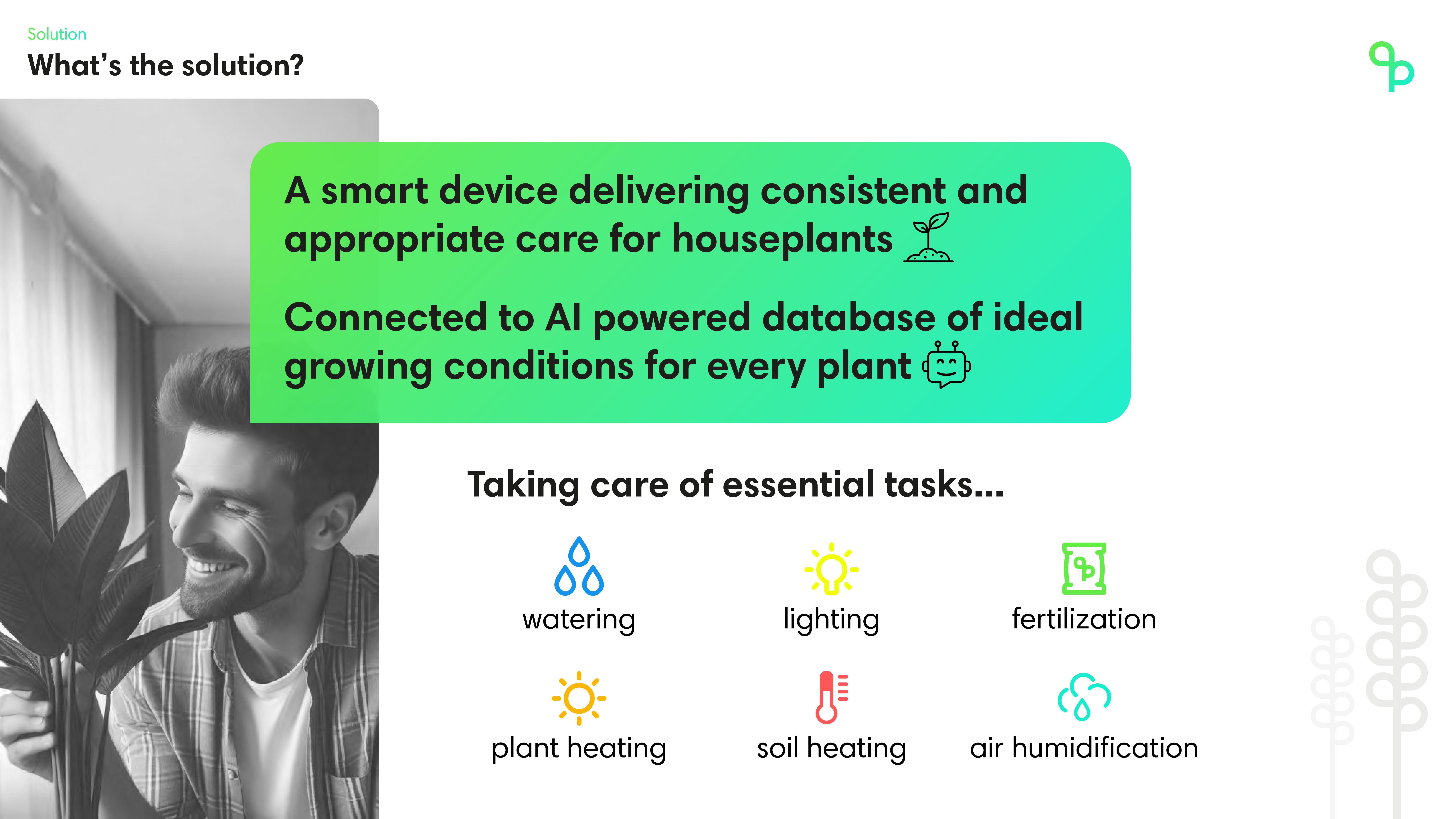

[Slide 8] Technology, AI and happy plants. Image Credits: Plantee

I’d hazard a guess that most plant owners think about light exactly once: when they first bring the plant into the house. They’ll think of watering as often as they can, hopefully before the plants are a dry, crispy, sad mess on the corner of the dresser. I’m glad there’s an AI taking care of all the other stuff, because I had no idea plants needed so much!

On the one hand, that’s a relief. On the other, perhaps I’m just a naive and novice plant daddy, but it left me a little confused. I’ve never heard anyone mention air humidification and soil heating. I could be persuaded that these things make a difference, sure, but I’m definitely curious to what degree it’s worth worrying about.

A good competitive landscape

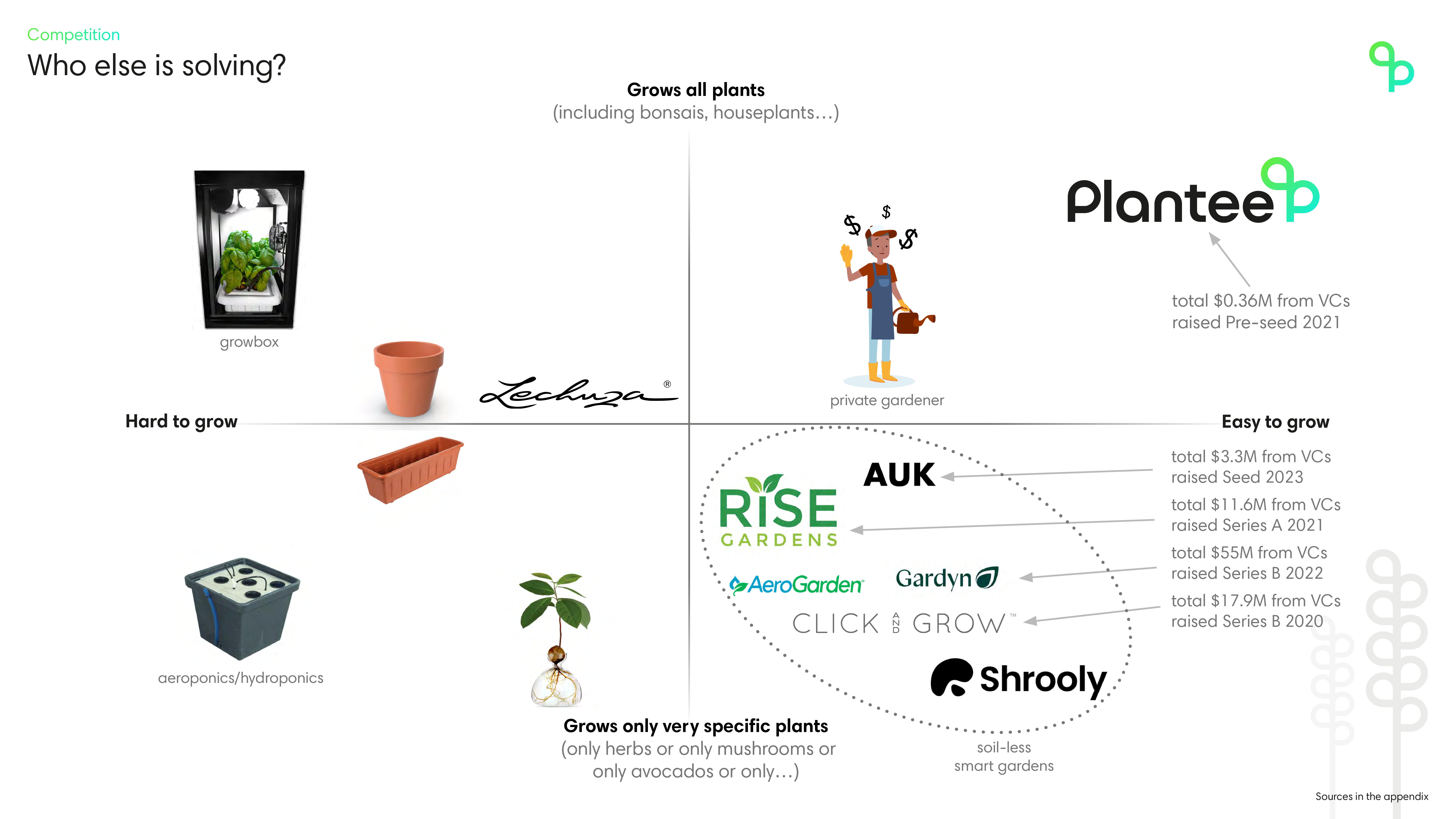

This is a market that doesn’t have many competitors. Seen through one lens, that’s a good thing: It means that there’s a thriving market, and Plantee can see what its competitors are doing well or poorly and position itself accordingly.

[Slide 10] That’s a lot of competitors. Image Credits: Plantee

As a competitive overview slide, this is pretty comprehensive. It separates the competitive landscape into “hard to grow” and “easy to grow” and specialist (e.g., mushroom/avocado growers) versus generalist growers. That all makes sense, but there’s still a little piece of the puzzle missing here: The only real exit in this space that I’m aware of is ScottsMiracle-Gro’s acquisition of AeroGarden, for around $50 million. Not the world’s smallest acquisition, but not wildly encouraging, either.

The other question I have is whether this dichotomy even makes sense. If someone plants a bonsai — a specific use case pitched by the Plantee team — they’re probably not going to repot the plant, which is an interesting challenge. If you’re positioning yourself in the market as a “you can grow anything,” I would assume that you’d want to replant occasionally. The little bonsai tree, however, can grow up to 800 years, so it’s hard to claim that the “grows all plants” argument is that strong of a selling point.

Three things that Plantee could have improved

On first impression, the Plantee deck is pretty extraordinary, and the AI tool gave it a 97% chance of success. As a human investor, I’m less convinced, and I disagree with the AI for a few crucial reasons.

Does it make sense as a product?

I love a good indoor growing system, and there have been many that tried (and failed) in this space. GROW raised $2.4 million back in 2017, before it eventually ground to a halt. I reviewed the $1,000 Abby a couple years ago, which, like Plantee, had pre-sold $100,000 worth of products on Kickstarter, and it was pretty awful. I’ve also built my own hydroponics system for under $150, which is obviously a lot more work, but it shows that these types of systems don’t have to be expensive.

Plantee is up against some pretty formidable competition. At the low end, for just $40 you can pick up a pod-based hydroponic system. If you want to spend a bit more, Click & Grow has your back. Rise Gardens recently raised a $9 million round. People kill house plants all the time, but most of them are pretty easy to take care of. If you need some help, a quick Google search for “AI plant growing app” gives you dozens of options, most of them free.

My biggest challenge with the Plantee deck isn’t what’s there, but it’s what’s missing: wider context. If you take all the company’s claims at face value, it’s an extraordinary opportunity. However, zoom out a little, and talk to a few plant lovers, and you realize that perhaps there isn’t as big a gap in the market as one might think. It seems that the inherent assumption in the Plantee story is that people who are bad at plants will spend $1,400 on a fancy automatic plant pot.

I’d argue that’s a fallacy and that people who are bad at plants instead get a kitten, or take up watercolors, or get a plastic plant, before they’re wiling to invest four months of car payments on a fancy piece of tech.

So what happened to that Kickstarter campaign?

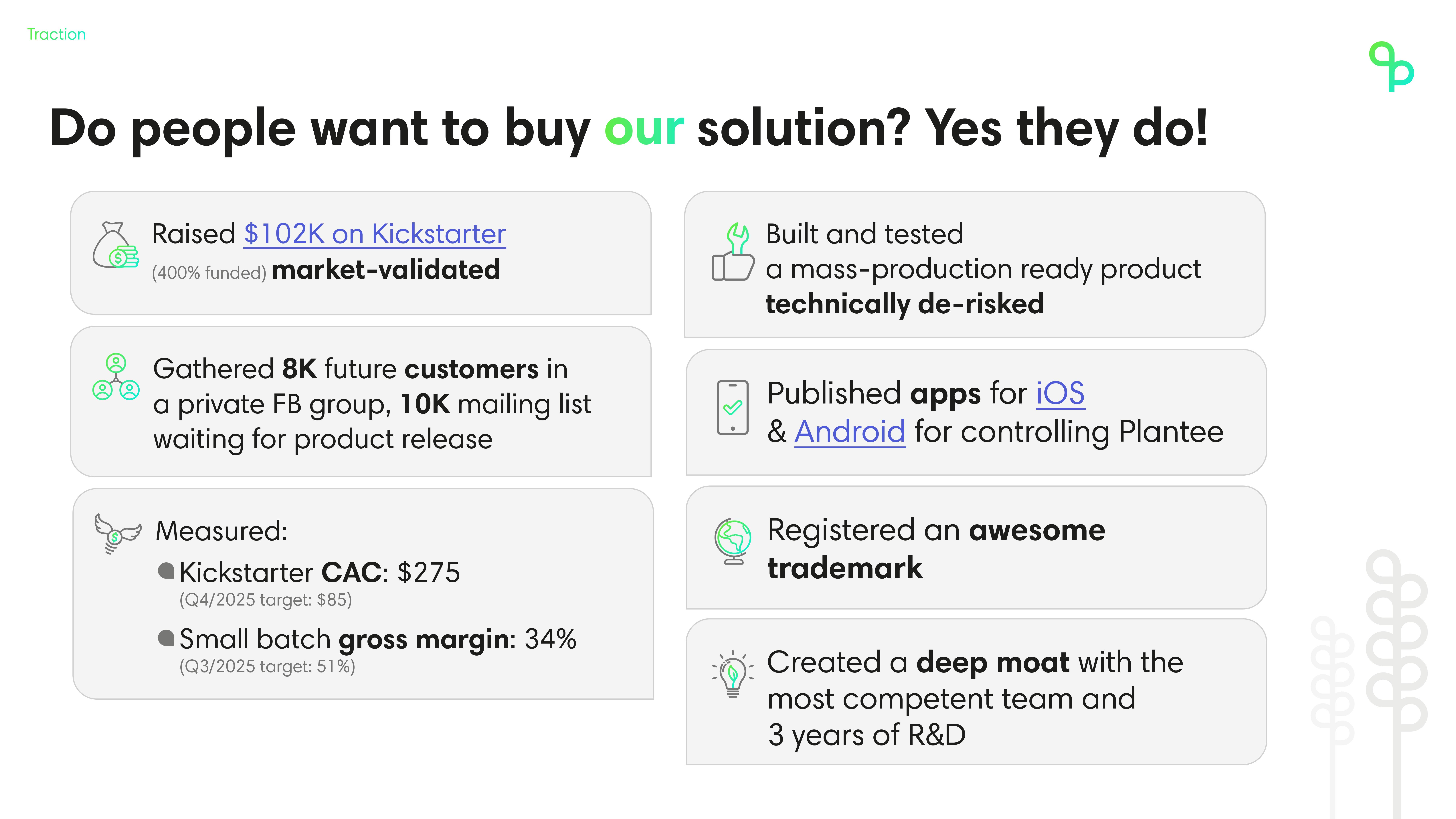

[Slide 11] Plantee is arguing front and center that its Kickstarter campaign is part of the market validation. But there’s a catch. Image Credits: Plantee

Plantee did, in fact, persuade 109 backers to pledge just over $100,000 for its product. The campaign was fully funded in less than eight hours but was canceled just under a month later.

What happened? Image Credits: Screenshot from Kickstarter

That puts the Plantee team in a strange position: It claims that the Kickstarter campaign proves market validation. And that might be true: The company says it was able to attract its preorder customers for a CAC of $275. By selling 109 units, basic math dictates that the company spent about $30,000 to make $100,000 worth of sales. That’s not too shabby, assuming that there’s enough margin in the product to make that customer acquisition cost make sense.

The problem, however, is that the company doesn’t mention anywhere in the pitch deck that the campaign was canceled, and it doesn’t discuss why it was canceled. It could argue that it never intended to deliver on the Kickstarter campaign and that it was just a marketing test to help confirm whether there was a market for this sort of thing.

I’m not sure that makes sense. Before Plantee’s campaign, EcoQube ($300,000 funded in 2019), GroBox ($70,000 funded in 2019), Herbert ($280,000 funded in 2019) and dozens of others had already been successful, and it’s not fully clear what Plantee learned from this exercise. Since then, a bunch of others have run successful Kickstarter campaigns (Herbstation, MarsPlanter, GrowChef).

Put simply, I’m struggling to figure out how the Kickstarter campaign fits into the overall narrative, and by seeming to skirt the issue within the deck, Plantee isn’t doing itself any favors. Perhaps I’m being painfully sensitive after one of my own Kickstarter campaigns went down in flames a decade ago, and eventually took the whole company with it, but personally, I’d include a “so, what happened with the Kickstarter” slide in the appendix to get ahead of that part of the story. Bad news should travel fast.

A little on the dramatic side

I love some good storytelling, don’t get me wrong, but parts of this pitch deck seem to have lost all perspective. Phrases like “never lose another green child,” “It started when my good friend died,” and “stress affecting the mental health of growers” are undoubtedly powerful and emotionally charged, but to those of us who’ve lost a good friend, had serious mental health challenges, or actually lost a human child, it seems pretty tasteless to compare the vast and almost unbearable pain of that with losing a house plant.

[Slide 5] I’m sorry for your loss, Ondra, but this is bordering on bad taste. Image Credits: Plantee.

The full pitch deck

If you want your own pitch deck teardown featured on TechCrunch, here’s more information. Also, check out all our Pitch Deck Teardowns all collected in one handy place for you!