What will the next government do to help?

By Navtej Johal, Midlands correspondent • Faisal Islam, Economics editor

BBC

BBCPeter Felix paints and decorates other people’s homes for a living, but he says it is frustrating that he cannot afford one of his own.

He and his partner, Rebecca Wilson, are in their early 40s. They have been renting together for nearly three years, and are losing hope of ever owning a house.

Peter is among the many people who got in touch with the BBC via Your Voice, Your Vote to tell us that housing is the most important issue for them during this election.

Peter and Rebecca, who works in car insurance, each earn about £30,000 a year before tax, and rent a three-bedroom house in south-west Birmingham.

Their rent is £950 a month without bills and has risen twice in the past 18 months.

Like many people around the UK, they are desperate to buy their own house, but are struggling to save enough for a deposit.

“To buy a house and rent at the same time is almost impossible,” says Rebecca.

They are beginning to wonder whether they should give up, or whether the politicians can promise them any help. It would win their votes, they say.

Housing policy has never been more important in an election. While the cost-of-living squeeze from rising energy and food costs has started to ease, there is no such luck with housing.

Getty Images

Getty ImagesHouse prices rose more steeply than usual during the pandemic and then plateaued, even falling in some parts of the country. But the latest signs are that they are going up again.

Rents have been climbing steeply since early 2021 and are still rising – up 6.2% in the past year.

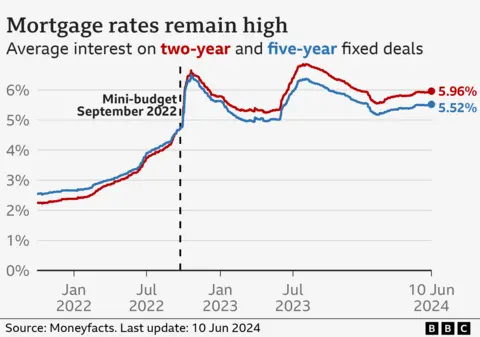

And mortgages are also more expensive. Borrowing rates started to rise in early 2022. An average two-year fixed rate mortgage was then just over 2%; it is currently just under 6%, making monthly payments more than double what they would have been.

In the last few elections politicians have made big claims on housing, ranging from a promise of mass right-to-buy from housing associations to punchy housebuilding targets. But they rarely delivered. A 300,000-a-year target for housebuilding has been missed. The pandemic, energy crisis, and interest rate hikes are factors, of course, but so is policy.

The UK has the highest housing costs in the English-speaking world. On average more than a quarter of disposable income is spent on housing. And the grubby truth is that when the cost of housing increases, whoever is in power tends to benefit. That is because voters who own houses feel like they are getting richer.

So there is little incentive for governments to dampen house price rises by making sure more are built, and a massive incentive to support buyers instead, through things like mortgage subsidies and stamp duty cuts – in effect subsidising demand. That has been the policy pattern that has delivered relentless increases in housing costs.

On top of that there is planning. Up and down the land, most Tuesdays and Wednesdays, councillors sitting on planning committees reject local housebuilding projects because that is largely what their voters want.

‘Grasp the nettle’

Without some kind of action, there is a very real chance the difficulties facing would-be homeowners and renters could get worse.

The Home Builders Federation (HBF) has released figures showing that planning approvals have “continued to plummet”.

Approvals for units – that is new homes – fell by 13% in the year to April, on top of sharp falls the previous year. Approvals for sites to be built on are running at levels even lower than in the aftermath of the financial crisis.

The HBF’s executive chairman, Stewart Baseley, says the figures illustrate the “stark challenge” ahead and that the next government will need to “grasp the nettle and be bold and brave” to tackle the barriers to supplying housing, the planning system, and support for buyers.

That kind of intervention would be music to the ears of Peter and Rebecca.

In Birmingham, where they are looking to buy, rents have been rising but house prices have fallen slightly, by 1.5% over the past year, according to the ONS, so they feel it might be possible.

They are looking for a three-bedroom house, so that Peter’s son from a previous relationship can have his own room when he stays over.

While Rebecca has never owned a property, Peter did have shared ownership in a flat before the 2008 financial crash. Back then he managed to keep up with his mortgage payments and is confident they would manage now.

“If I did it when I was 25, then I can definitely do it now – especially when there are two incomes,” he says.

But they have calculated that at their current rate of saving – £100 a month each – it would take them five years to save enough for a deposit. In the meantime they fear rents could go up again, other costs may increase, and house prices may rise so that their dream remains out of reach.

It can feel like you are fighting a losing battle, says Rebecca.

“You save and save and save and it’s just never going to be enough,” says Peter.

What are the parties promising?

The Conservatives would build homes, prioritising brownfield development. They would permanently waive stamp duty tax for first-time buyers of properties costing up to £425,000. This threshold was raised temporarily and is due to revert to £300,000 in March 2025.

Labour would reform planning rules, fast-forward development on brownfield and what it calls “grey belt” land such as car parks. It wants to extend an existing scheme, which helps people get a mortgage with a smaller deposit and is backing more rights for renters.

The Liberal Democrats want additional social housing and new “garden cities”. They support local authorities that want to end the “right to buy” policy for council housing, ban no-fault evictions, make three-year tenancies the default, and create a national register of licensed landlords.

The Green Party would invest in new social housing and bring empty properties back into use. They would set higher environmental standards for new builds and would require more affordable units. They support rent controls and an eviction ban.

The Scottish National Party has declared a national housing emergency and is promising funding for new affordable homes across Scotland, including for rural and islands projects.

Plaid Cymru would expand social housing and support the Welsh construction industry. The party would allow local authorities to buy back more second homes and holiday lets. They want a ban on no-fault evictions and rent controls.

Reform would fast-track planning, offer tax incentives for development on brownfield sites and give tax breaks to small-scale landlords. People born in the UK would be given priority for social housing.

Additional reporting by Lucy Hooker